What You Need To Know About Pre-Approval

Some Highlights

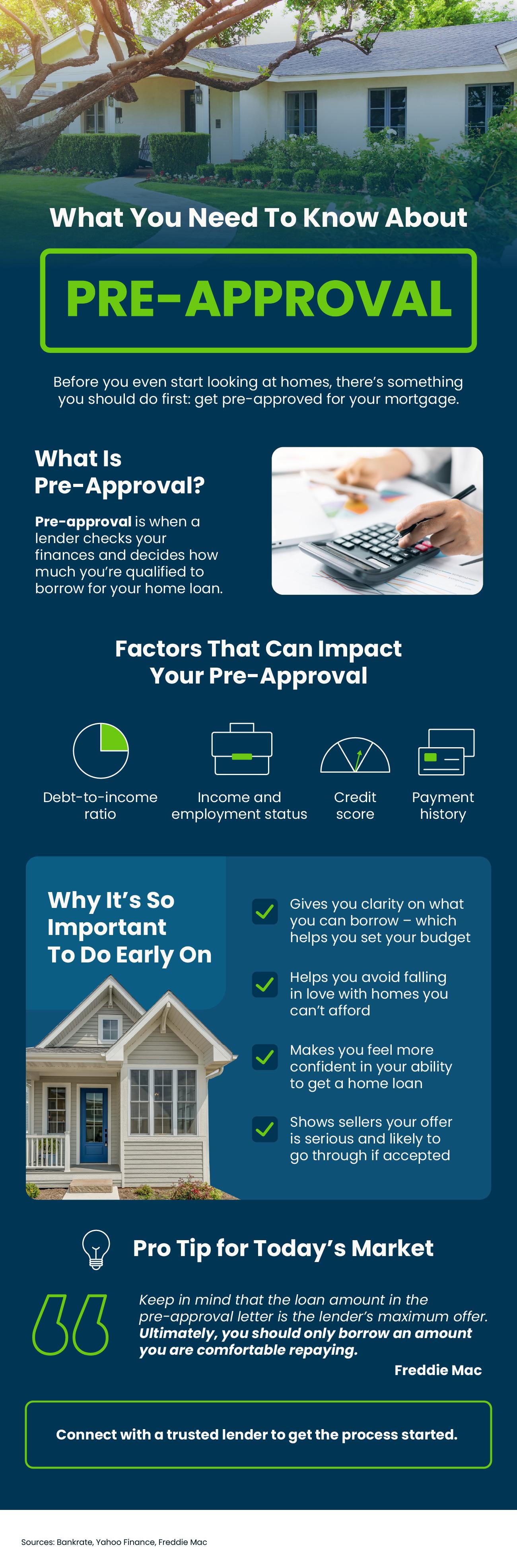

- Before you even start looking at homes, there’s something you should do first – and that’s get pre-approved for your mortgage.

- Pre-approval is when a lender checks your finances and decides how much you’re qualified to borrow for your home loan. This helps you determine your budget and makes your offer stand out for sellers.

- Connect with a trusted lender to get the process started.

Categories

Recent Posts

3 Advantages of Buying a Newly Built Home Today

The Truth About Down Payments (It’s Not What You Think)

The 3 Things You Risk by Pricing Too High

What Credit Score Do You Really Need To Buy a Home?

Home Price Forecasts for the Second Half of 2025

Today’s Tale of Two Housing Markets

Housing Market Forecasts for the Rest of 2025

The U.S. Foreclosure Map You Need To See

The Latest Mortgage Rate Forecasts

Don’t Make These Mistakes When Selling Your House