What Is the VA Funding Fee? A Simple Guide for VA Buyers

When it comes to VA loans, one of the least discussed aspects is the VA funding fee. It’s not just a line item in your closing costs—it’s a key part of how the VA loan program stays sustainable for future veterans.

Let’s break it down:

What is it, why does it exist, how much is it, can you avoid it—and what happens when you sell?

What Is the VA Funding Fee?

- No down payment

- No private mortgage insurance (PMI)

- Competitive rates

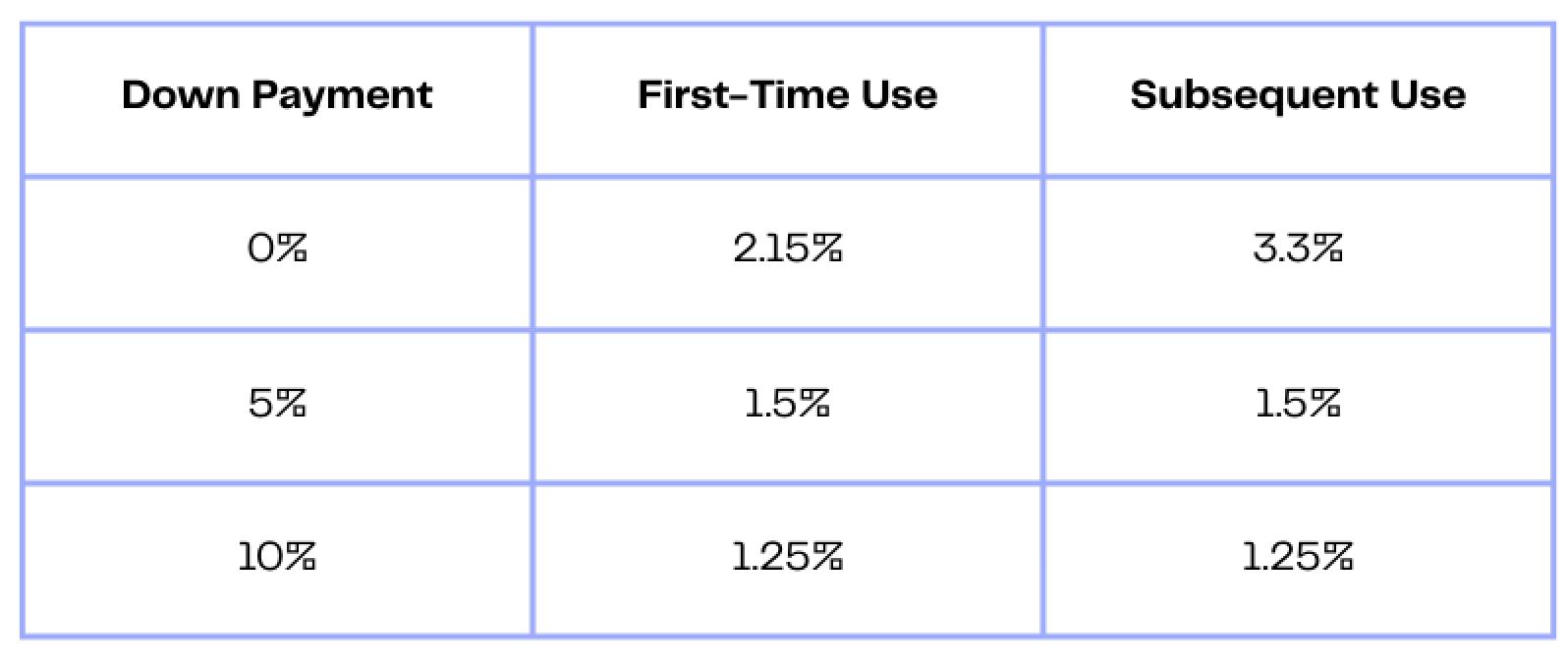

How Much Is It?

- Your down payment (if any)

- Whether this is your first or subsequent use of a VA loan

- The type of loan (purchase, cash-out refi, streamline refi)

- Whether you’re exempt from the fee

Buying a $400,000 home with 0% down on a first-time VA loan? Your VA funding fee would be $8,600.

Can You Roll the Funding Fee Into the Loan?

- Home price = $400,000

- VA funding fee (2.15%) = $8,600

- Total loan amount = $408,600 if you roll the fee in

Who’s Exempt From the VA Funding Fee?

- You receive VA disability compensation (even 10%)

- You’re eligible for compensation but receiving retirement pay instead

- You’re a surviving spouse of a service member who died in the line of duty or from a service-connected disability

What Happens When You Sell?

The VA funding fee isn’t refundable unless you become eligible for an exemption retroactively. But when you sell your home:

- The loan is paid off in full—including the funding fee

- There’s no penalty or extra fee at closing

- Your equity is based on your home’s value minus the total loan balance (which includes the funding fee)

The Takeaway

The VA funding fee is a small price to pay for one of the most powerful loan programs available. It eliminates the need for PMI, allows for 100% financing, and opens the door to homeownership for those who’ve served but, it does impact your homes equity and you Net proceeds when you sell.

Whether it’s your first home or your next chapter, let’s make sure you’re maximizing your benefits and planning smart.

📞 Ready to run your numbers or check your eligibility? Let’s connect—I’m here to guide you every step of the way.

Categories

Recent Posts